It’s common knowledge that the real estate landscape is a measure of economic health and development, and in the case of the United Arab Emirates (UAE), it’s a testament to unparalleled growth and unparalleled luxury. With a vast array of iconic structures gracing its skylines, the UAE’s real estate sector stands as a global benchmark for what’s possible in the realm of architecture, innovation, and opulence.

But beyond the shining exteriors and majestic interiors lies a complex and evolving market that is balanced for continuous expansion. This blog post explores the appearance of the luxury real estate market in the UAE — from its meticulous planning to its dynamic growth, analyzing the trends and opportunities that make it an investment hotspot and a homebuyer’s dream.

The Attraction of UAE’s Real Estate Resilience

Amidst the geopolitical hassle and economic fluctuations that define the global marketplace, the real estate segment in the UAE persists as an example of unwavering resilience. It has shown remarkable stability, attractively low tax rates, and a concerted push towards diversification.

In rent-to-own schemes, the UAE has provided a model of creating incentives for long-term investment, allowing new homeowners to transition gradually towards full property ownership. Furthermore, the COVID-19 pandemic encouraged the UAE government to provide fiscal support for real estate with initiatives like the Dubai 2040 Urban Master Plan, positioning it for a robust post-pandemic recovery.

TOP 3 Property Markets of UAE

When discussing the UAE’s real estate markets, it’s essential to analyze the top three that drive its sector’s narrative.

Dubai – The Pinnacle of Luxury and Diversity

Home to the world’s tallest building, the Burj Khalifa, Dubai symbolizes ambition and sheer extravagance. It boasts a diverse real estate market, with luxury properties alongside affordable housing. The emirate’s property laws, which allow foreigners to own freehold on certain properties, have attracted a vast international clientele.

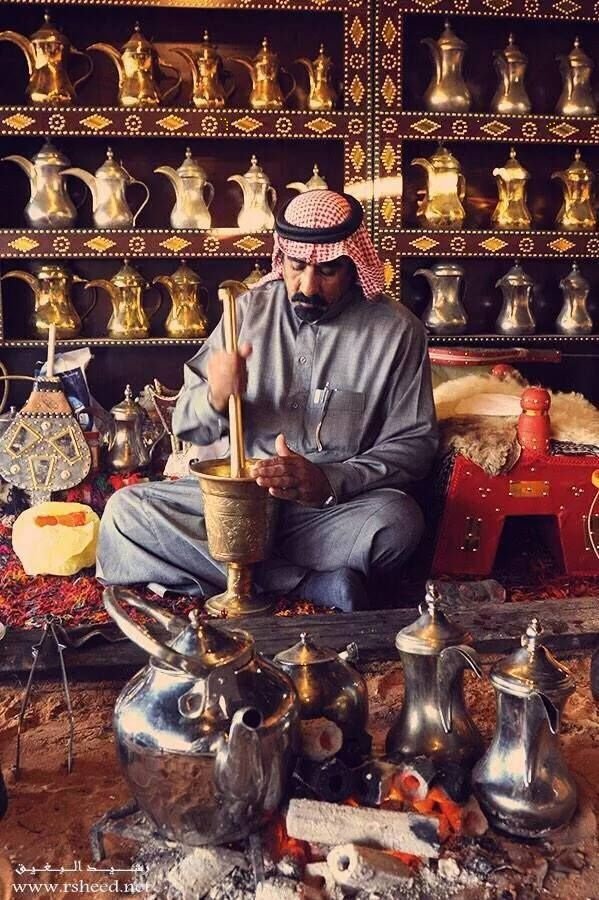

Abu Dhabi – The Balancing Act of Growth and Tradition

Abu Dhabi stands as the country’s capital and the locus of its traditional values. It is gradually emerging into a real estate powerhouse bolstered by a 2030 Economic Vision plan that seeks to diversify its economy. The upcoming arts and culture district, Saadiyat Island, embodies Abu Dhabi’s vision by bringing high-end cultural institutions alongside premium living spaces.

Sharjah – The Cultural Hub’s Commercial Ascendancy

Sharjah is transforming from the overlooked sister of Dubai and Abu Dhabi into an economic dynamo. This renaissance hinges on development initiatives like Sharjah Waterfront City that aim to create sustainable communities. These projects come with attractive price points in comparison to its neighboring emirates, making it an increasingly popular choice for both residents and investors.

Real Estate in the UAE – A Buyer’s Guide

The UAE’s real estate market is characterized by its unique set of laws and dynamic property trends, making it both an attractive and complex environment for potential buyers. Here are a few key considerations for anyone looking to invest in or purchase property in the UAE:

Understand Property Market Cycles and Drivers

To make informed investment decisions, it’s crucial to develop an understanding of the market cycles that influence the sector. For instance, current drivers include Expo 2020 Dubai and the Ras Al Khaimah Investment Authority’s (RAKIA) ongoing efforts.

Navigating Property Laws and Regulations

The UAE has undergone legislative changes to make the real estate market more accessible. Understanding these laws, such as the introduction of long-term residency visas for investors, retirees, and skilled workers, can ensure a smoother buying or selling process.

The Importance of Local Network and Expert Consultation

Navigating the UAE’s real estate sector requires insight and local knowledge. Establishing a network of real estate professionals and seeking expert advice is invaluable in securing the right property at the right price.

The Real Estate Landscape Post-COVID

The global pandemic has catalyzed significant shifts in consumer behavior and work patterns, which in turn are redefining real estate preferences. In the UAE, this has translated into an increased demand for larger homes that can accommodate remote working and homeschooling.

Additionally, there’s a growing emphasis on sustainability, with buyers gravitating towards eco-friendly properties. The government’s introduction of green initiatives, such as the National Climate Change Plan and the Dubai Clean Energy Strategy 2050, reflects a commitment to fostering a green real estate landscape.

What the Future Holds: Dubai 2040 Urban Master Plan

Projections present a hyper-connected and sustainable future for Dubai with the Dubai 2040 Urban Master Plan. This visionary initiative aims to enhance the city’s global competitiveness, focusing on 5 key areas — economy, society, environment, infrastructure, and living. Its significance lies in the ambitious projects planned including the expansion of the metro network, green spaces, and a focus on community-centric living that promises a diverse real estate portfolio for investors.

Niche Opportunities and Emerging Trends

Apart from traditional investment avenues, niche sectors within the UAE’s real estate market present unique opportunities. For example, the hospitality sector is making a comeback with a focus on luxury resorts and serviced apartments that cater to premium travellers and expatriates looking for long-term stays.

Another burgeoning trend is the rise of co-living and co-working spaces that deliver a modern living experience for a growing population of young professionals and entrepreneurs. With the Gulf region’s moves toward tech innovation and entrepreneurship, these spaces are becoming vital hubs for the region’s emerging talent.

Strategic Investment in the Age of Real Estate Intelligence

In an age of information and digital transformation, strategic investment necessitates thorough research and the adoption of advanced tools like real estate intelligence platforms. These tools can provide investors with data-driven insights, predictive modeling, and market analytics that empower them to make informed and strategic decisions.

Investors in the UAE can leverage such platforms to stay ahead of market trends, identify growth opportunities, and monitor the performance of their real estate assets. By combining this technology with local expertise, they can build portfolios that are both robust and responsive to the UAE’s dynamic market environment.

Conclusion

The UAE’s luxury real estate market stands as a testament to the country’s vision, ambition, and unwavering commitment to excellence. Fueled by strategic planning, favorable economic conditions, and an environment that encourages innovation, it continues to be the pinnacle of property investment.

For those looking to engage with the UAE’s real estate sector — whether as investors, enthusiasts, or potential homeowners — understanding the market’s unique dynamics and staying abreast of the latest trends is paramount. With its promise of growth, prestige, and a life of luxury, the golden sands of the UAE real estate market are truly beckoning to be explored.